Bitcoin ETFs are driving the crypto rally

For several weeks now, the price of Bitcoin (BTC), the largest cryptocurrency by market capitalisation, has been rising sharply again. The oldest and most well-known digital currency has appreciated by 60% this year alone and by 140% over the course of a year. The opportunity since January to invest in Bitcoin in the USA through exchange-traded funds (ETFs) has been the main factor behind the recent surge in its price. Another factor is the forthcoming halving of the rewards for mining new Bitcoins and its increasingly deflationary effect on the cryptocurrency, as well as the generally optimistic sentiment in the financial markets.

These positive developments, however, were preceded by more challenging times. Just over a year ago, in January 2023, the Bitcoin price was around USD 20,000. This marked the beginning of a recovery for Bitcoin after the tumultuous decline in its price in 2022 due to the collapse of major cryptocurrency projects and rising interest rates.

Spot Bitcoin ETFs

The price of Bitcoin has rallied since mid-2023 at the prospect of the US Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs. Major US asset managers such as BlackRock, Fidelity and Grayscale submitted applications for these ETFs. Unlike their predecessors, which primarily used futures contracts to participate in Bitcoin’s price movements, these new ETFs take a direct approach by actually holding Bitcoin in custody. This means that investors no longer have to deal with the complexities of decentralized on-chain exchanges or interact with centralized cryptocurrency exchanges, which represents a significant advance in the ease of entry into the cryptocurrency market and reduced trading barriers for both retail and institutional investors.

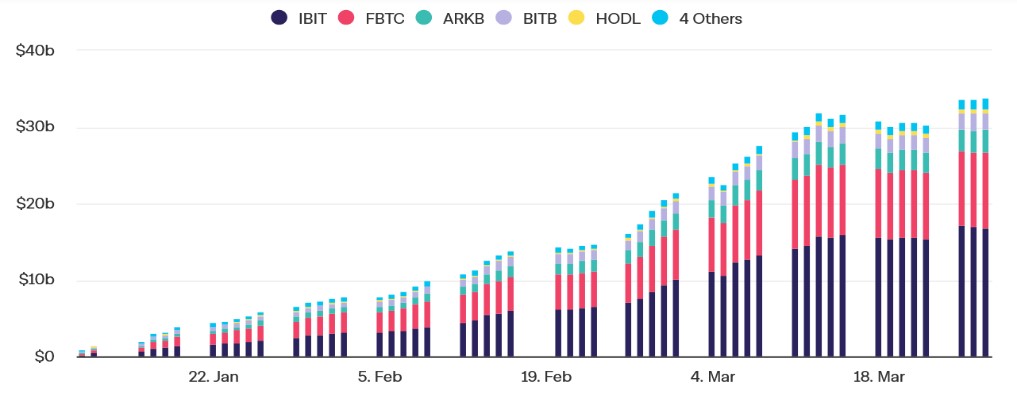

Approved in the USA on 11 January, Bitcoin ETFs saw volumes increase at record speed (Fig. 1) and propelled the cryptocurrency to a new all-time high of around USD 73,750 on 14 March. BlackRock’s iShares Bitcoin Trust (IBIT) reached USD 10 billion in assets under management in just over seven weeks – a figure that took the first US gold-backed ETF more than two years to achieve. In February, Bitcoin briefly became the second-largest ETF commodity in the USA, surpassing even the market capitalization of silver.

The halving in April

Another catalyst that historically has had a bullish effect is just on the horizon – the bitcoin halving. Planned for 20 April of this year, the event will reduce the Bitcoin block reward for miners from 6.25 BTC to 3.125 BTC. In Bitcoin mining, new Bitcoins are created and transactions are verified in a process that involves using powerful computers to solve complex mathematical problems. The halving happens approximately every four years in order to control supply and increase scarcity, like with gold. While currently about 900 new Bitcoins are mined per day, the supply will decrease to roughly 450 new Bitcoins on average per day. Historically, the price of Bitcoin has developed positively after each halving event, with the combination of limited supply and rising demand often leading to price surges. This process will continue until the total number of Bitcoins in circulation reaches the maximum limit of 21 million (at this point in time there are about 19.6 million), which, it is estimated, will happen around the year 2140.

Outlook

By authorizing ETFs, the SEC was able to integrate Bitcoin and crypto trading, which had been regulated only to a limited extent, into its supervisory framework and in so doing create fertile ground for sustainable growth. The best-performing asset of the past decade can consolidate its supremacy through broader acceptance and accessibility. Last but not least, fundamental data such as the forthcoming halving, buying pressure from ETFs and possible interest rate cuts in the coming months will provide further tailwinds. As a strategic portfolio allocation, an investment in Bitcoin is not only an opportunity to diversify systemic risks, but also an investment in a disruptive technology – the blockchain.

Author: David Portmann

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!