Endless Debt

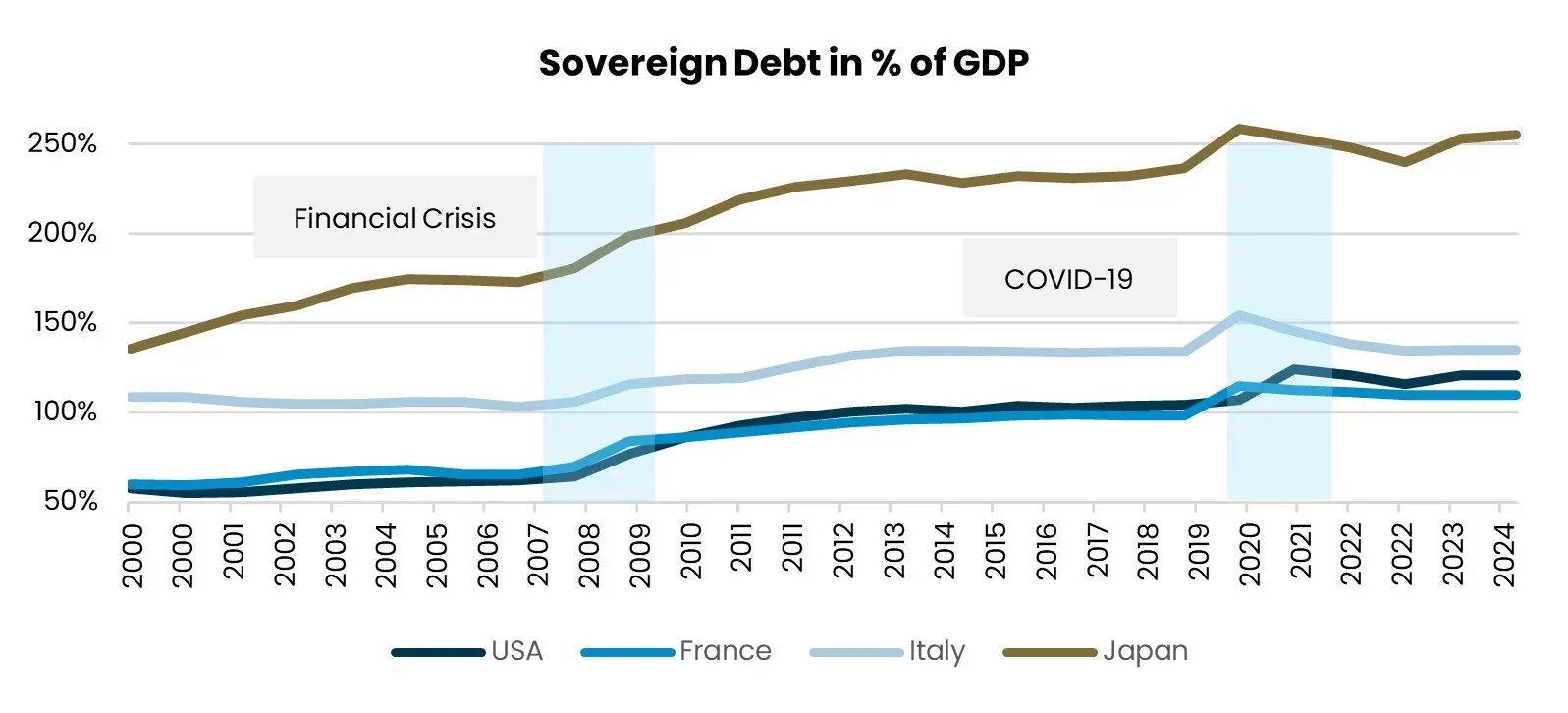

Global government debt will reach new record levels in 2025. At over USD 102 trillion, it now corresponds to nearly the entire global GDP. The United States, with around USD 36 trillion in debt and an annual debt growth of roughly 5.8% in 2024, is the primary driver of this development. Japan’s debt exceeds 250% of GDP, Italy stands at 135%, and France at approximately 114%. These elevated debt levels have caused growing unease since the Financial Crisis of 2007/08, a concern that intensified during the COVID-19 crisis (see chart). Thanks to historically low interest rates, the impact on public budgets remained limited for a long time. But now, the situation — especially in the US and Japan — appears to be reaching a point where it could seriously unsettle financial markets.

USA Lacking Fiscal Discipline

US sovereign debt now meets a financing environment that is becoming increasingly fragile. The Federal Reserve continues to reduce its bond holdings in 2025 as part of quantitative tightening, although at a somewhat slower pace. At the same time, foreign buyers such as China are withdrawing as creditors from the US for geopolitical and strategic reasons, making it even more difficult to place US Treasuries. The US Treasury must refinance more than USD 7.5 trillion by the end of the year — nearly 20% of total US debt. This will negatively affect long-term US interest rates — regardless of the level of the Fed’s policy rate — meaning upward pressure on yields. When a greater supply of Treasuries meets declining demand, US creditors will be able to demand higher interest rates.

Meanwhile, spending on defense and industrial policy is rising sharply. Political polarization makes any structural consolidation of debt much more difficult. President Trump’s planned tax reform package — called the “Big, Beautiful Bill” — will further increase the US deficit. Although proponents expect short-term growth impulses, the intended financing via cuts to social programs carries significant potential for social conflict. The accompanying strategic policy shift — often referred to as the “Mar-a-Lago Accord” — links trade policy with national security by threatening countries that fail to comply with tariffs and a withdrawal of US military protection. In doing so, foreign creditors could be forced to roll over existing debt into long-dated US bonds with low interest rates.

This combination of structural deficits, rising interest costs, and growing uncertainty undermines confidence in the sustainability of US debt and weakens the dollar’s status as the world’s reserve currency.

Japan with Record-High Inflation

Meanwhile, financial tensions are increasing in Japan. With over 250% government debt, persistent inflation of around 3.5%, and more than half of its government bonds held by the Bank of Japan, it is likely that the continued financing of government spending will rely on freshly created central bank money (monetization of debt). In addition, Japan’s recent interest rate turnaround is eroding the foundation of the global dollar-based carry trade, where capital is borrowed cheaply in yen and invested in USD assets. The unwinding of these positions could trigger massive capital outflows and exert downward pressure on the dollar. Strategists are warning of a sudden return of large capital flows to Japan. At the same time, Japan’s own refinancing costs are rising — posing a significant risk for the world’s most indebted industrialized nation.

Conclusion

The current debt situation has the potential to seriously destabilize financial markets. For Swiss investors, this means keeping foreign currency risks low. Gold and Bitcoin are increasingly establishing themselves as hedges against uncertainty.

Author: Rafael Gonzalez

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!