Gold as an investment and crisis protection

Gold has always been considered the epitome of value and security. Although proverbs such as “All that glitters is not gold” reminds us that appearances can deceive, the precious metal is currently shining brighter than any other asset class. Having increased by over 40% in USD terms since the beginning of the year, gold recently reached a new all-time high, driven by a combination of monetary, geopolitical, and structural factors.

During the Bretton Woods system (1944 – 1971), the gold price was fixed at USD 35 per troy ounce by government regulation. After the end of the gold standard, pricing was left to the free market. The following decades were marked by fluctuations and sharp price increases. A high in the late 1970s was followed by a period of stagnation. In August 2020, gold reached the USD 2’000 mark, supported over the preceding years by the aftermath of the global financial crisis, the euro debt crisis, the COVID-19 pandemic, and rising geopolitical tensions. Since then, prices have advanced substantially, nearly doubling over the period. The following factors have led to this surge:

Monetary policy

Macroeconomic conditions are the main drivers of the rise in the price of gold. In September 2025, the US Federal Reserve resumed its cycle of interest rate cuts in view of a slowing labor market, despite persistent inflation. It also signalled a further two interest rate cuts by year-end. Combined with falling real interest rates and a weaker US dollar, this created an extremely favourable environment for gold. Furthermore, doubts about the independence of the Fed are reinforcing gold’s appeal as a safe haven.

Geopolitics

In addition to monetary policy, geo-political tensions are fuelling demand for stable assets. Protectionist measures, such as US tariff policy, are further stoking uncertainty. Moreover, high levels of government debt and its sustainability are a source of concern in the US, Japan and France.

Structural factors

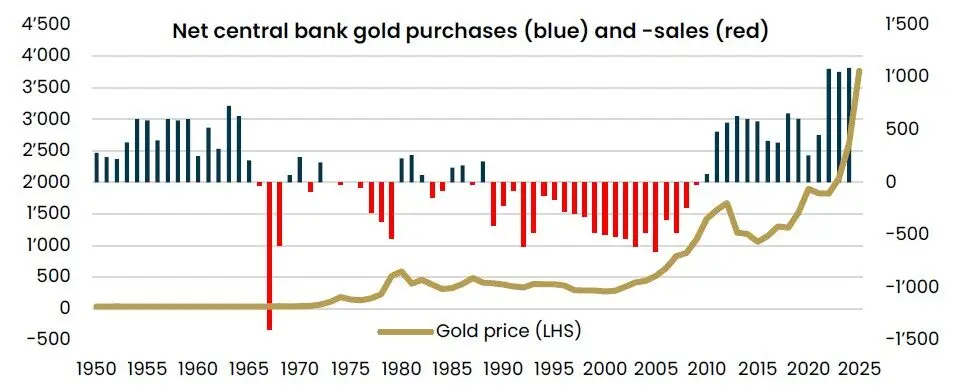

The support provided by central banks is particularly notable. The freezing of Russian assets in 2022, in response to the invasion of Ukraine, likely served as a warning to authoritarian states. Consequently, central banks are expanding their reserves in gold to diversify their dollar holdings. Accordingly, central bank purchases have become a key pillar of demand. At over 1’000 tonnes per year since 2021, these purchases are twice the average of the previous decade (see figure). China and Russia are among the most active buyers, signalling their opposition to the Western monetary system (de-dollarisation). Private investors are also showing strong interest, with gold ETFs recording their highest inflows since 2010 in the first half of 2025.

Risks

Although cyclical factors such as interest rate cuts, lower real interest rates and a weaker US dollar, as well as structural factors like demand from central banks, provide support, there are nonetheless risks. If US inflation were to re-accelerate, the Fed could be forced to raise rates again. This would strengthen the USD and increase the opportunity cost of gold. Likewise, a strong US economy or geopolitical de-escalation could dampen demand.

Conclusion

The factors mentioned above point to further upside for gold prices. Although risks remain, the gold market’s fundamental strength outweighs them. We continue to view gold as a hedge against uncertainty.

Author: Michel Mammarella

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!