Impact of Trade Tariffs

Following his return to the White House, Donald Trump is once again pursuing a hardline stance on trade tariffs: he has already doubled the levy on Chinese imports from 10% to 20% and imposed a blanket 25% tariff on all global imports of steel and aluminum – including those from Canada and Mexico. Temporary exemptions for selected USMCA products (US–Mexico–Canada Agreement) are set to expire shortly. Canada responded immediately with 15% tariffs on US agricultural goods, while China retaliated with 25% duties on US exports worth USD 30 billion. Is the next escalation already looming?

Continuity Instead of Policy Shift

Already during his first term (2017-2021), Trump pursued an aggressive “America First” tariff strategy. At the center were punitive tariffs of up to 25% on Chinese imports (with a volume of around USD 360 billion) as well as tariffs on steel (25%) and aluminum (10%). The stated goal was to protect US industries and reducing America’s trade deficit. The outcomes were mixed, however. The deficit remained persistently high, while US businesses and consumers faced higher costs. Biden (2021-2025), too, made few changes to Trump’s tariff policies. Two-thirds of Chinese imports continued to be subject to tariffs averaging around 19%, supplemented by new trade restrictions targeting strategic goods such as electric vehicles and semiconductors.

Escalation Intensifies Under Trump 2.0

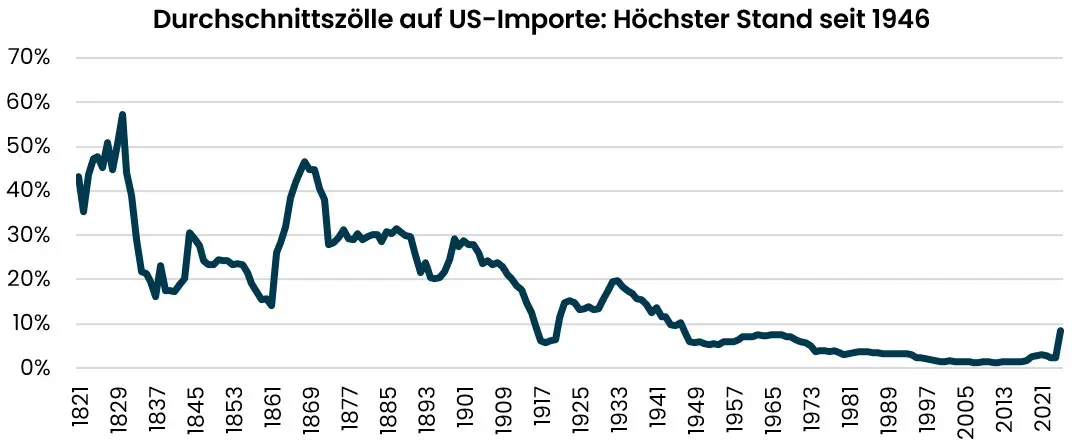

Trump is intensifying his trade approach. Alongside existing tariffs, he’s now proposing “reciprocal” tariffs, under which the US would raise duties wherever its current tariffs are lower than those of its trade partners. Indeed, the average global tariff on US exports stands at roughly 6%, compared to the US tariff average of 2.4%. In the automotive sector, for instance, the EU imposes a 10% tariff on American cars, while the US charged only 2.5%. Economists caution, however, that reciprocity in Trump’s interpretation could elevate US tariffs to their highest levels since the 1960s (see Fig. 1). As a consequence, forecasts suggest real US GDP growth in 2025 could decline by 0.6%, and the price level could rise by as much as 1.2%. American households would face additional annual costs of between USD 1’600 and USD 2’000. For Europe, the newly implemented 25% tariffs on European automotive imports are particularly severe, potentially reducing eurozone GDP growth by up to 0.5%. Financial markets are already responding with heightened uncertainty. For Swiss companies, tariffs imply disrupted supply chains and upward pressure on the Swiss franc, negatively impacting exports and corporate profitability.

Tariffs: Empirical and Historical Evidence

Research (by institutions such as NBER and the Peterson Institute) demonstrates that tariffs result in long-term welfare losses, with businesses and consumers bearing nearly the full burden of increased costs. Trade deficits are seldom significantly reduced, imports simply shift geographically. Historically, excessive tariffs, such as those enacted by the Smoot-Hawley Act of 1930, exacerbated global crises. Trump’s first term confirmed this pattern: sectors temporarily shielded by tariffs, like steel, initially benefited, while other industries simultaneously faced rising input costs. Global growth slowed, with the World Bank estimating losses at that time amounting to 0.8% of global GDP.

Conclusion

Trump’s threat of trade tariffs creates uncertainty and disrupts global trade flows. Initial consequences are already evident. Global growth is weakening, and consumer sentiment is deteriorating. While we do not anticipate a global recession even in the event of further escalation, given that economic fundamentals remain solid, an intensified trade war would nonetheless become a negative-sum game in which ultimately all parties lose.

Author: Rafael Gonzalez

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!