Private markets: an update

Global financial markets are still working through the effects of the end of the low interest rate phase. Following the unprecedented losses experienced in traditional bond and equity portfolios in the 2022 investment year, investors are looking for opportunities to diversify.

According to a survey of Swiss high-net-worth individuals (HNWIs) conducted by Lombard Odier in June 2023, increasing their allocation to private market investments was one of the most cited ways to improve portfolio diversification, with 42% of those surveyed mentioning this approach. The younger the survey respondent, the greater their readiness to increase the allocation of their portfolio to private market investments appears to be. Among the under-35s, the figure is as high as 63%.

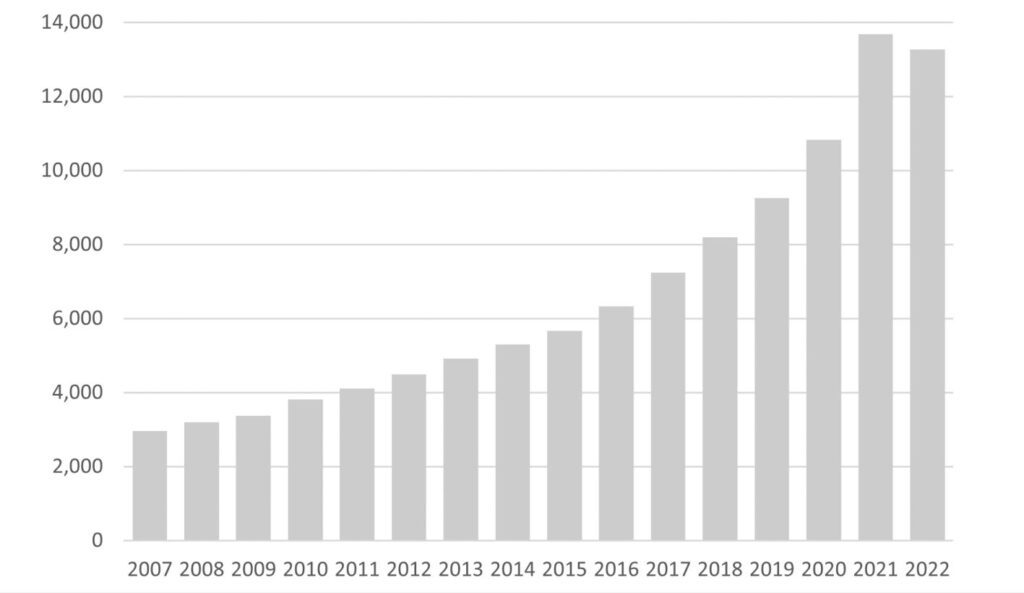

Investors’ growing interest in this asset class is evidenced by the high amount of capital continuing to flow into private markets (Fig. 1) and also reflects a shift that is taking place within the financial world: value is increasingly being generated outside traditional financial markets – by companies that no longer necessarily aspire to go public. The much higher interest rate environment, more restrictive lending by banks and economic uncertainty have affected the subclasses in the private market universe in different ways.

Private Equity (PE)

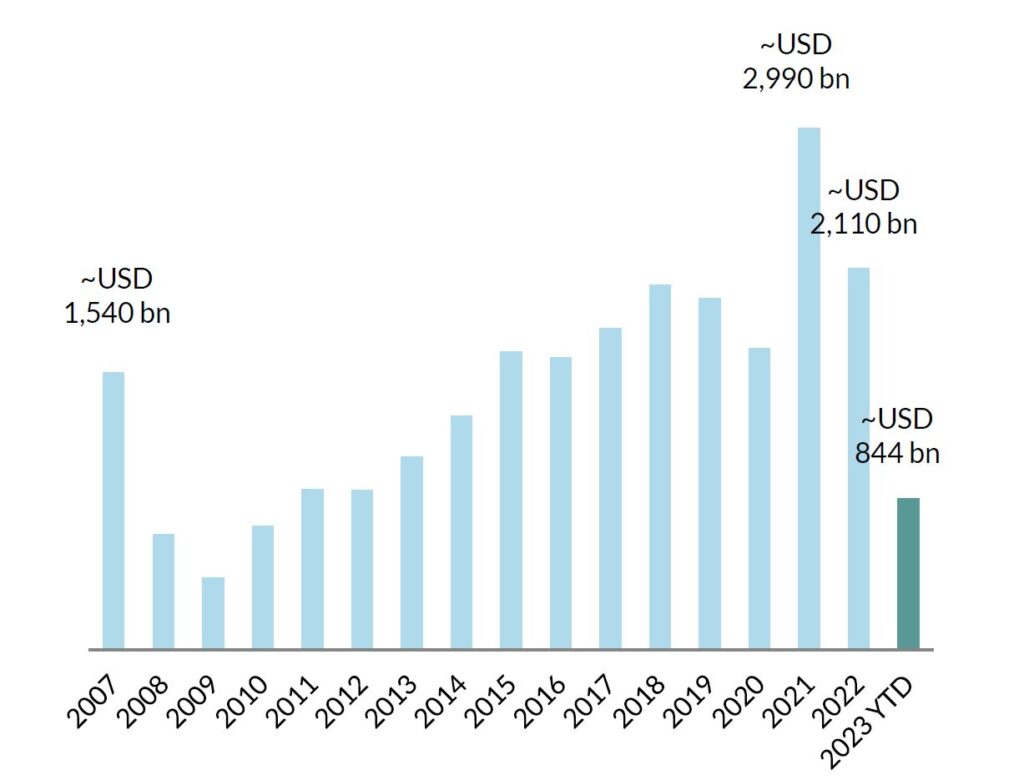

Higher interest rates have caused the costs of financing deals to practically double (to approx. 10%) within the course of a year. At the same time, banks have tightened their lending standards amid increased uncertainty. These framework conditions and diverging price expectations caused the volume of deals to slump in 2023 (Fig. 2).

Reduced deal volume combined with lower demand have naturally also led to corrections in valuations. Enterprise value (EV) to EBITDA multiples – a widely used metric in the PE industry – are down around 5-15% (according to various data providers) from the highs posted at the end of 2021. As the earnings outlook for the underlying companies remained, by and large, positive, the valuations of PE investments, for the most part, were little changed during this period.

According to figures provided by Partners Group, there are close to 20 projects in the Partners Group universe ready for exiting. All options are being looked at, including initial public offerings (IPOs). The re-opening of the exit window could provide some upside potential. Lower interest rates would act here as a catalyst.

Private Debt (PD)

The same factors that have a negative impact on the PE sector have a positive impact on deals in the PD universe. Leveraged buyout (LBO) financing in the private market is typically based on a short-term base rate plus a credit risk premium (spread). Significantly higher base rates, higher credit risk premia (spreads), more favourable contractual terms or covenants for creditors and generally lower leverage (i.e. a higher equity ratio) are currently resulting in higher potential returns with lower risks than was the case two years ago. But here, too, we emphasise the importance of good-quality private debt!

Real assets (Private Real Estate/PRE and Private Infrastructure/PI)

While PRE is also suffering from high interest rates and uncertainty about future utilisation is making deals almost impossible in some subsectors (offices and department stores), investments in infrastructure projects are becoming increasingly popular. The steady long-term cash flows are particularly attractive for institutional investors.

Conclusion

The changed market environment has also shaken up the private market universe. In order to command higher valuations in the PE universe, the exit window needs to open up. Lower interest rates and reduced uncertainty could support this in 2024. In the PD space, it is currently possible to achieve higher returns with lower risk.

Author: Reto Jung

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!