IPOs are making a comeback

The global initial public offering (IPO) market has been treading water since its record year of 2021. Whereas just two years ago there was a gold-rush mentality, the past year and the current year are among the worst in over a decade.

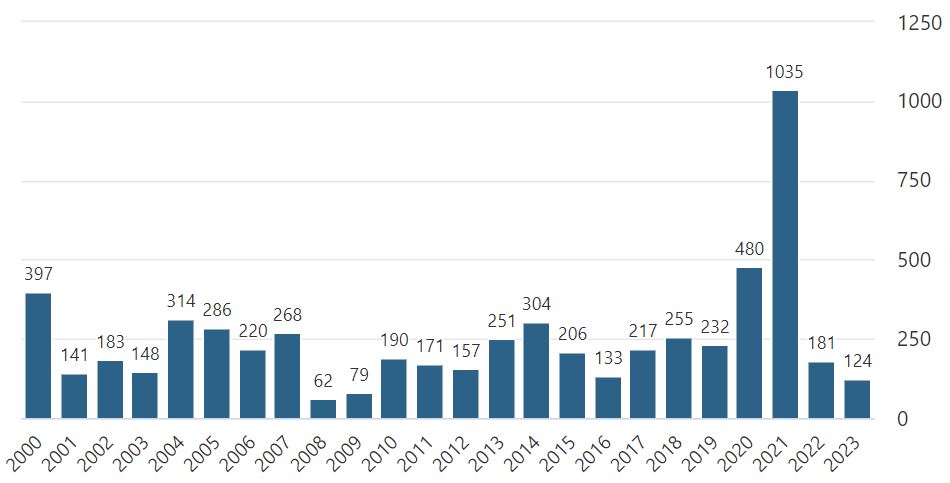

Let’s look at these in turn. Between 2000 and 2022, there were almost 6,000 IPOs on the world’s largest stock exchange, the New York Stock Exchange. The lowest number of IPOs in a single year was in 2008 with 62 (Fig. 1). Stock markets were confronted at that time with the financial crisis. 2021 holds the all-time record for IPOs on the US stock market with 1,035. Interest rates were low and investors were desperate to find attractive investment opportunities. A record number of companies such as Coinbase, Rivian, Roblox and the Swiss running shoe manufacturer On rushed to IPO that year.

The IPO market has been in the doldrums ever since. There were 181 IPOs on the US stock market last year, while only 116 IPOs have been recorded so far this year. The picture is similar in the private market, where exits – i.e. planned divestments – have come to a virtual standstill.

Factors in the IPO decline

Broader market conditions are to blame. Geopolitical tensions and supply chain bottlenecks pushed inflation to a 40-year high. Central banks reacted with the most aggressive rate tightening cycle in 40 years. Through their action, they sucked the air out of the inflated valuations of many companies, having previously contributed to exaggerated valuations in the era of zero interest rates. In addition, inflation and recession fears have curbed investors’ appetite for risk.

In the private market universe, sharply higher interest rates and more restrictive bank lending have made the financing of takeovers much more expensive. This has made the disposal of participations more difficult.

Performance

The 2020–2021 wave of IPOs has performed miserably by historical standards. The median of all US IPOs underperformed the Russell 3000 (US small- and mid-cap stocks) by 48 percentage points in the first twelve months after going public. By comparison, the median of all IPOs since 1995 is minus 20%. Of the IPOs launched between 2020 and 2021, only 18% have outperformed the

Russell 3000. The median figure for all IPOs after 1995 is 35%.

Is an IPO revival imminent?

The situation in the IPO market is beginning to improve. A significant catalyst was the recent mega IPO of British chip designer ARM Holdings. Although only 10% of the shares were floated, the owner, SoftBank, raised USD 5 bn. Other companies have also gone ahead and taken advantage of the IPO window with candidates such as Instacart, Klaviyo, Schott Pharma and Birkenstock. There has not been a single IPO in our home market of Switzerland since the beginning of the year. With the spin-off of Sandoz, planned for 4 October 2023, the door for IPOs is now reopening in Switzerland too.

Private equity companies have also been intensifying discussions on exits in the past few months. Partners Group, for instance, is planning as many as 20 exits over the course of the next 18 to 24 months. And IPOs are also being considered as an option again. As with, for example, Techem, a German energy services provider for the real estate and private homeowners sector.

It is highly unlikely that there is going to be a flood of IPOs now this year. The market environment remains fragile, though inflation seems to be tamed and the rate hiking cycle has likely peaked. IPO activity can, however, be expected to pick up pace over the next two years.

Author: Michel Mammarella

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!