Repercussions of the War in Ukraine for the World Economy

The policy of appeasement towards Vladimir Putin these last thirty years has failed colossally with the Russians’ invasion of Ukraine. After a year of war, its direct and indirect impacts can be more readily assessed.

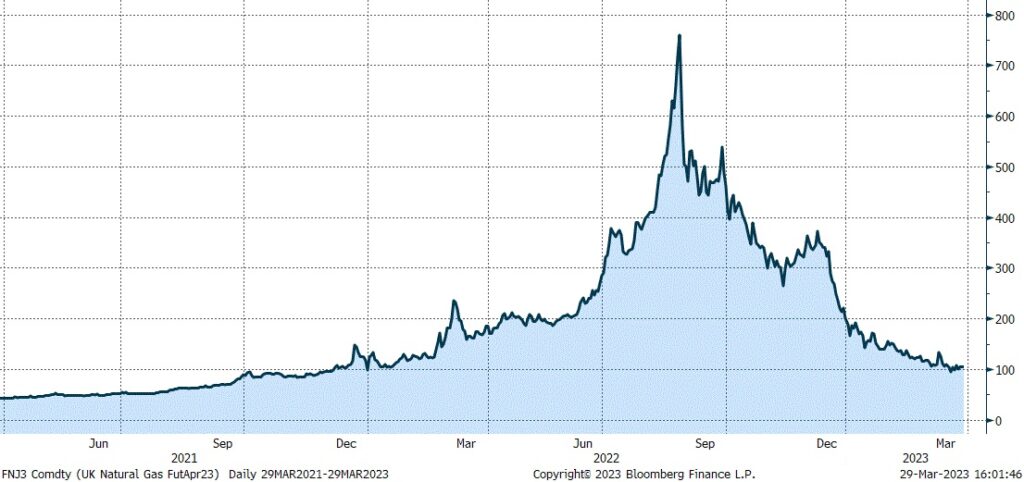

Although Russia and Ukraine are relatively insignificant in global economic terms (accounting for roughly 2% of global GDP in February 2022), the invasion still triggered a massive shock. The energy and food markets were particularly impacted, with scarcity of supply and considerable uncertainty about availability, catapulting prices to unprecedented levels (Fig. 1).

One year after the outbreak of war the conflict has not yet ended. The related humanitarian catastrophe aside, the worst fears of negative repercussions for the global economy have not materialized. With global energy and raw material supplies largely secured, the corresponding prices have normalized and recession has so far been avoided in the major economic regions.

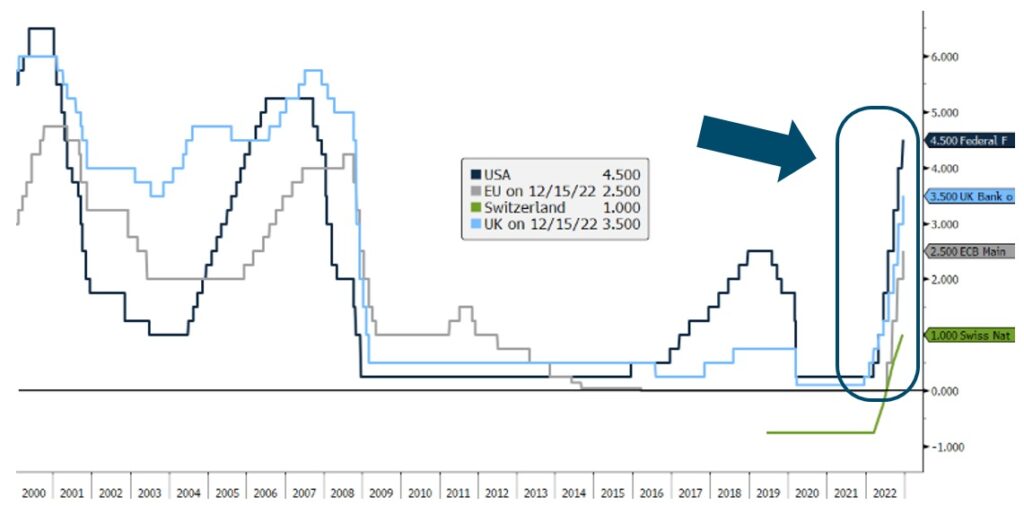

Core inflation, however, still remains stubbornly high (e.g. CH: 3.3% in January 2023) despite the normalization of prices. In the slipstream of rising energy prices, many companies have probably not only passed on the direct cost increases to their customers. They also rose their own price margins. Profits are driving inflation, creating a profit-price spiral. This type of inflation is difficult to fight even through higher interest rates. Despite the risks, central banks have had to make very aggressive key rate hikes in order to maintain their credibility (Fig. 2).

Current Situation

The war has gone from being a major market driver to a background risk. The global financial markets have become accustomed to the constant war rhetoric and the horrific images. Russia has also lost its oil and gas supremacy much faster than initially feared. Thanks to the mild winter, energy prices have fallen again and in some cases are trading below pre-war price levels. What’s more, Europe is making great strides in reducing its dependence on Russian oil and gas by securing alternative energy sources.

Formation of Blocs

The formation of blocs – with Western democracies (USA, Europe, etc.) on one side and authoritarian regimes (China, Russia, etc.) on the other – has, on the other hand, gained considerable momentum.

The fear of a Chinese invasion of Taiwan has increased significantly. The strong authoritarian Chinese President Xi Jinping has declared full reunification with Taiwan, a foreign policy goal during his term in office. After the negative experiences with Putin, such statements now cause greater nervousness in the West. Such a conflict would have devastating consequences for the global economy, as Taiwan is an indispensable link in the global supply chain and is, among other things, the largest producer of semiconductors in the world.

China has big domestic problems to contend with, including a real estate crisis, high local governments’ debt, and negative population dynamics. Unfortunately, a foreign policy conflict would also be a conceivable and convenient way for the Communist Party to divert attention away from its own problems.

Author: Nils Häller

We are at your service

Your personal partner for all matters relating to your assets.

We look forward to hearing from you!